Looking back on 2021

— FIRE, Retrospective — 6 min read

When it comes to finances 2021 has been an exciting year for me: I properly started my FIRE journey! More specifically I got personal finances in order, I made my first real investments, and I learned a lot about what it will take to reach my FIRE goal. Additionally, my partner and I made the massive step of buying a new house and selling our previous house. Now it's time to put this all into perspective and see where it fits in the grand scheme of things.

Personal finances

One of the goals I set in 2021 was to cut recurring expenses in our household.

Because I've only recently started looking into my finances I could not really put it into numbers properly. Because of this, to start off this adventure, I settled on "just cut expenditures"

One of the biggest ways I cut costs was by selling our 2nd car

This reduced my personal expenses by 130 euros per month. Which already accounted for three percent of my monthly income.

additionally, on average it saved my business another 500 euro in monthly maintenance costs.

Because of these early savings, I managed to build up a significant buffer for my business.

By the end of 2021 I accumulated a buffer of over 2 months worth of salaries!

On the side of my personal finances, I also managed to increase my buffers.

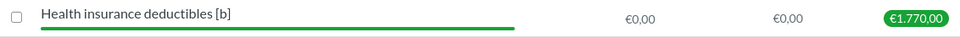

My main concern for this was our health insurance deductibles.

Mainly because I don't want anything to hold us back to seek out medical care when we need it.

I can proudly say that this buffer increase has also been accomplished and my buffer is now large enough to cover any deductibles that might come my way in 2022!

Besides this, I have also been working on building a buffer to cover any extra (medical) expenses I might encounter regarding our dogs, so we can keep them happy and healthy.

Unfortunately, our eldest dog had some medical issues this year which mostly reset all my progress.

However, this has only strengthened my resolve to keep this personal buffer topped up because it enabled me to ensure she got the best help available.'.

Once I have this buffer on a level I am comfortable with, I would like to focus on increasing the maintenance buffer for the house and our car.

Once I have this buffer on a level I am comfortable with, I would like to focus on increasing the maintenance buffer for the house and our car.

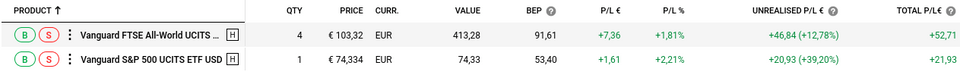

Investments

2021 marked the start of my investment portfolio. I've started my investments with 2 very popular ETFs. The first is the vanguard S&P 500 index. This index follows 500 biggest american stocks based on their market capital. The second was the very popular vanguard all world fund. This follows the All-World index which covers around 4000 stocks from around the globe.

As you can see both funds did very well this year. My portfolio value is up by quite a large percentage. However, this is not my primary interest since given a long enough timespan the market always goes up. The thing we care about it time on market. And in that sense I'm very happy I've made a start. My goal for the coming year is diversifying a bit more in my investments.

Buying and selling a house

A big highlight in 2021 was finding our new home. It was a wild journey in a not so buyer friendly market. As luck would have it, we managed to find a house that perfectly suits our needs. Although the actual transaction won't be until early 2022, the process of buying a house so far has already resulted in quite some costs. Firstly, I spent over a thousand euros on a house we ended up not buying. Secondly, for the house we did end up buying I still spent nearly a thousand euros for taxation and inspections. Lastly, I spent another thousand euros to sell our current home. Due to the current housing market, I decided to sell the house myself. This saved me quite a bit of money that I otherwise would've had to pay to a real estate agent. Of course, in addition to the costs of moving and selling a new house also brings different expenses. But more on that once we've settled into our new house.

goals 2021

I had set two financial goals for 2021:

- Have a buffer of three months' worth of income.

- Have fewer recurring expenses

Did I achieve those goals? Not quite...

As always, there is some nuance. For my first goal I wanted three months' worth of income as buffer, but I didn't define where I wanted this buffer. When setting this goal I had my personal finances in mind. In this case I did not meet my goal. I had a buffer of €2673 over all categories and this was only 64% of my monthly income instead of the desired 300%. However, when looking at the business side of the budget I had a buffer of around €9000. Together this amounted to 278% of my monthly income. Not quite my goal but pretty darn close. For me this is an indicator that I should do something with this split between business and personal accounts. Clearly, only taking into account personal finances would show a wrong picture when looking at our savings rate.

But the question is: did I manage to cut my recurring expenses?

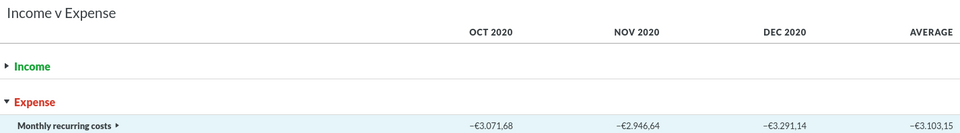

I'm very happy to say that I did! Here you can see the average monthly recurring expenses for Q4 in 2020

The average recurring expenses were €3103.

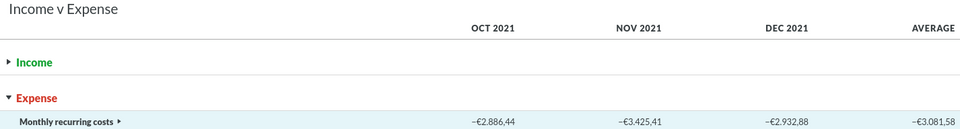

Now compare this with Q4 2021

The average recurring expenses were €3081.

That's €24 less than 2020.

That comes down to just 0,5% extra savings rate!

I reduced the recurring costs quite a bit with the sale of the second car.

However, this is offset by the fact that I started taking guitar lessons.

This confirms that reducing costs is challenging.

In addition, in 2022 I will have a bigger house with a bigger mortgage.

So keeping a close eye on my recurring costs for 2022 will be crucial.

The average recurring expenses were €3081.

That's €24 less than 2020.

That comes down to just 0,5% extra savings rate!

I reduced the recurring costs quite a bit with the sale of the second car.

However, this is offset by the fact that I started taking guitar lessons.

This confirms that reducing costs is challenging.

In addition, in 2022 I will have a bigger house with a bigger mortgage.

So keeping a close eye on my recurring costs for 2022 will be crucial.

goals 2022

Average days in personal account

A budgeting platform called You Need A Budget (YNAB) inspired me with a concept they call 'Age of Money'. This concept looks at the amount of time it takes for your income to be spent. So, in essence, this is a reflection on long you can pay your expenses without having income. Instead of looking at your buffer from an income perspective you look at it from an expenses perspective. I want a buffer of three months, so I can endure a longer period of no income. This metric fits that reasoning better than months of income since I shouldn't be bothering with saving during these periods.

So my first goal of 2022 is to achieve an 'Age of Money' of least 90 days by the 31st of September. Meaning I would have an effective buffer of three months.

Minimum savings rate

As I've mentioned in my path to fire blog, I am going to need a savings rate of 58% if I want to achieve retirement by the age of 45. To force myself to always think about this I want to give myself a minimum savings rate. Although, this minimum savings rate won't get me to my ultimate goal, it does force me to put money into the market. Having this money invested in the market earlier will result in a longer time on the market. This will result in a higher accumulation of compound interest per euro invested. Meaning that every additional compound interest accumulated will make the money invested more efficient.

So, my second goal of 2022 is to have a minimum of 10% savings rate every month.

Average savings rate

Of course, only sticking to the minimum will not get me near my goal. To achieve this goal, I will need to increase my average savings rate. However, I still have some big hurdles to overcome to reach 58%. This year I will also buy and move into my new home. This will introduce its own recurring expenses, some of which I can't determine the amount of yet. Additionally, I haven't fully built up my buffers yet. To help keep finances available to cover these expenses, I decided to set the bar a bit lower

My final goal for 2022 is to have an average savings rate of over 30%.

I'm sure I'll struggle with all these goals from time to time, however I'm confident that I will be able to achieve them. The first hurdle, the purchase of the new house, will already be at the end of January. I will tell you all about that in an upcoming blog

So long and thanks for all the reads - Mr Sound